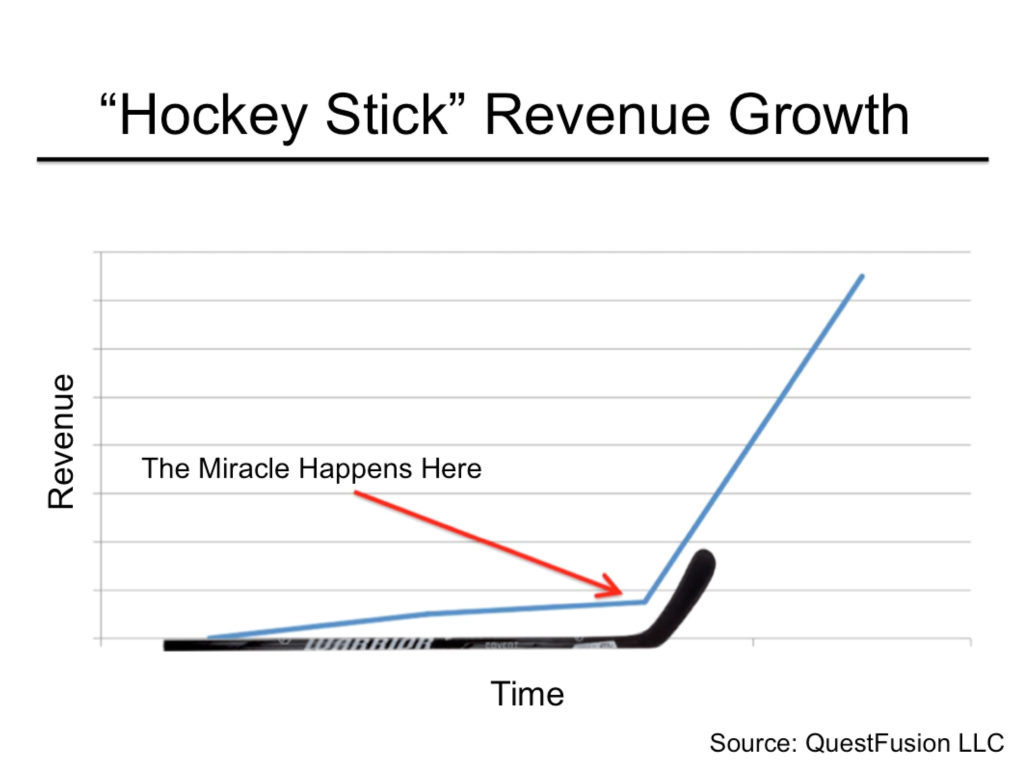

Have a solid explanation for your hockey stick revenue growth or risk not getting funded.

I have looked at hundreds of startup financial projections over my career–and pretty much every one I have ever seen has this so-called “hockey stick” revenue growth. This makes sense if you are addressing a market with potentially explosive growth. However, there needs to be some rationale as to the timing of the aggressive ramp.

When I listen to these investor presentations, I am waiting for the explanation of why the revenue curve accelerates at a particular point, and I am typically disappointed that there is not any real reason. Most presenters have no underlying reasoning for why the revenue automatically hockey sticks at that particular time. They might as well put on the slide: “The Miracle Happens Here.”

The Concept of Virality in Revenue Growth

As a startup CEO, you do need to be able to explain why you think your revenue will accelerate at a particular time based on underlying factors in the market and your business. If you don’t do this, it will be one of the biggest mistakes that you can make with prospective investors and it will undermine your credibility with them. That said, you must forecast rapid revenue growth at some point to garner interest from Angel investors and venture capitalists.

Exponential growth is when adoption takes on a life of its own, like something going viral on the internet, but it is important to explain why this phenomenon is going to happen in your revenue forecast. What is important about these concepts from a revenue acceleration standpoint is that your solution is understood and valued on a widespread basis.

A good indication that you’ve reached this status is that people, or more importantly, a significant percentage of customers in your target market, have “heard” about your solution and already have a basic understanding of what it does when someone else mentions it.

There are many solid explanations why you expect your revenue to grow rapidly at an accelerated rate at a given time. A number of key reasons are:

Landing the industry leader as a customer: In a business-to-business company, gaining adoption by a large customer that is ramping your product rapidly can drive significant growth, and just as importantly, the adoption by the industry leader may lead other key customers to adopt your solution as well.

Proof of concept at scale: An early adopter customer goes into production with your product or service and it validates the value proposition of your solution. You use that data in case studies and testimonials, and incorporate that into your promotional materials. You get rapid acceptance of your solution by additional customers that provide even more validation.

Expert or thought leader endorsement: Similar to adoption by an early adopter customer, the public endorsement by an industry expert or thought leader provides validation of your solution to their audience. If the expert’s audience overlaps with your target customer base, this validation can pave the way for accelerated revenue.

Reaching a critical cost or price point: In this case, customers are using your solution in a limited way, then it reaches a sufficient volume or achieves learning economies to “break through” to a lower cost, which enables a lower price and opens up a set of much higher-volume applications.

Government body approval: In this case, government approval is required for either widespread use or even for your solution to be used at all. Examples here are a drug that gets FDA approval, or a communications technology that gets FCC approval.

Finding a new high volume usage model: In 1989, at the drug company Pfizer, scientists Peter Dunn and Albert Wood created a drug called sildenafil citrate that they believed would be useful in treating high blood pressure and angina, a chest pain associated with coronary heart disease. This drug later became Viagra, which is used to treat erectile dysfunction, apparently a very high volume market opportunity, which is why many other companies try to capitalize on the market, providing similar products like these found at https://www.vigrx.com/products/vigrx-tongkat-ali/ for example.

This is not an exhaustive list, but you get the idea.

State Your Assumptions and Be Prepared to Explain and Defend Them

In any situation where you show acceleration in your revenue forecast, for it to be taken seriously by investors you need to clearly state your assumptions. Keep in mind that it is not uncommon to grow in “spurts.” You may get a burst in revenue then plateau before getting your next burst.

There can also be “lumpiness” in revenue growth. This can frequently be attributed to seasonality in your end market. Regardless of what you show in your revenue forecast, you need to be able to state your assumptions and be prepared to explain and defend them.

This article originally appeared in Inc Magazine.