I was recently working with a small group of entrepreneurs in my virtual coaching workshop, and we were discussing the essential elements of a startup business plan financial section. We had a good discussion about the importance of getting this right, and the key elements in each component of the financial plan for investors, and for running a business. Every business needs a financial plan to make sure that they’re reaching their financial targets. If a business isn’t confident creating their own plan, they could always consider getting some comprehensive financial planning help to make sure that their business has appropriate financial goals in place for the future. Furthermore, we also looked into the concept of making sure you have the right form of insurance for your business. Looking into the question of what is public liability insurance led us to understand why this is one of the main types of insurance policies that many business owners need. Running a business, or even planning the initial stages takes a lot of time and consideration, but this is an essential part of the process.

As we all know, it is difficult to attract outside investment in any startup venture, and it is even more difficult if you don’t show prospective investors a path to explosive growth in revenue and profitability over time. As such, the financial section of a business plan is an essential component of getting a company funded. There are loads of other parts that need to be considered, regarding the financial section, for example, how to save money in a business is also very important. One way you can do that is getting cheaper business energy, you can learn more here.

I looked on the web for other resources and insights, and the available information, especially for startups, was pretty sparse. I did find a good article in Inc., How to Write the Financial Section of a Business Plan. It is worth checking out. However, I thought this article would be of some value to the entrepreneurs other there working on their business plans. Small companies can do most Financial Planning & Analysis (FP&A) using Microsoft Excel spreadsheets, or the Google equivalent, but there are also a number of really good FP&A software tools on the market, may are reviewed in Top Budgeting Software Products. If you are not a finance person, the best bet is to hire a freelance FP&A person to support your project. You can find them on Fiverr, Guru, Thumbtack and other freelance sites. If you don’t want to hire a freelance person then you could easily use a Virtual Finance company to help you instead, which might be a bit easier.

In the beginning of a startup, you need to include startup cost in your business model, but I’m going to focus on companies that have already been in business and have refined their idea to a point where they are either deep in product development or possibly even selling their first product or service. So what are the key components of a financial model and how do you realistically integrate it into a business plan? It must:

- Shows a successful story

- Have a realistic and clear path of execution

- Be believable by potential investors in your company

(1) Revenue Projections

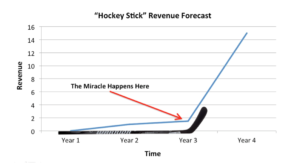

Revenue growth is the most important component of any startup business plan. Nearly every startup business plan that I have reviewed, and there are hundreds over my career, show a revenue plan with explosive growth, sometimes called “hockey stick” growth. This model, as it is so aptly is named, shows no growth for a prolonged period of time followed by an infection point and exponential growth. As I read a business plan or listen to an investor presentation with this revenue growth model, I try to stay patient and listen for the explanation of what causes the exponential growth, but I’m usually left with the thought in my mind, “And the miracle happens here.” Don’t do that. We’ll discuss tie-in with the market size and growth below.

At the end of the day, revenue is simply unit volume times price per unit. The higher the unit price, the faster you can grow revenue with volume. The amount you can charge for your product or service is a direct translation of its value to the customer. This translates back into your unique value proposition and your competitive advantage. Disruptive technologies provide these types of market opportunities. It is worth reading The Innovator’s Dilemma by Clayton Christensen.

(2) Gross Margin Expansion Over Time

Revenue without gross margin is nice for vanity points, but it isn’t a real business. You must have a good understanding of you average selling prices (ASPs) and cost of goods sold (COGS). Gross margin is described as a percentage and calculated as follows:

Gross Margin = (ASP-COGS)/ASP

Investors want to see products with high average selling prices, as long as they can drive explosive volume growth. The also want to see product with healthy or even high gross margins. If you haven’t reached a cost point for your product that allows for high gross margins, but the margins would expand with economies of scale or learning economies, that is fine. You just need to show the gross margin expansion in your financial models, and explain why it will occur.

One other key point about gross margins: At the end of the day, dollar margin is more important than percentage margin, but some investors will get fixated on percentage gross margins. Have a business model that shows healthy gross margins.

(3) Operating Expenses

How much does it cost to build your product and run your business? Check out The Top 7 Essential Business Expenses for Entrepreneurs for ideas. Most startups lose money in the beginning. It is not the end of the world as long as you have a path to making money. When I joined Entropic, we were still pre-product and pre-revenue. We had raised tens of millions of dollars in venture capital investment, and I told my team, “We have shown that we can raise money and spend money. Now it is time that we show that we can make money.” We started generating revenue in the next year, and were profitable on a pro-forma basis in the third year of my tenure. Now, Entropic was building a complex hardware product with a very long sales cycle. Most companies should not have to wait that long to be profitable. To garner investor interest, your financial model must show a reasonable timeframe for break-even, and “operating leverage” over time. In simplest terms, a business model with operating leverage shows operating margin growing at a faster rate than revenue. Investors LOVE businesses like that, and you should too!

(4) Capital Requirements

Most startups are not very capital intensive, so this is not as essential for software companies or Internet companies. Capital is stuff that you buy that lasts a longer time, so from an accounting standpoint; you don’t expense it all at once. Instead you put it on your balance sheet as an asset and expense it over time. This is called depreciation. Investors in startups will be even more interested in your cash requirements and cash management than ‘accrual accounting”, so if you do have large capital requirements, it is very important that you explain what you need and why. In many of my former companies, even those that outsourced manufacturing, we had some reasonable capital requirements for lab equipment, servers, and tools. Your cash requirements to support capital expenditures are an important part of you business model, so include them. As a startup, look at ways to be frugal in your capital spending. Don’t buy everything new. Lease where it makes sense.

(5) Cash Flow Analysis

Cash is king in a startup environment, especially pre-profitability. As mentioned above, you need to clearly articulate your cash requirements, what you plan to use the cash for, and what milestones you can expect to achieve based on this cash usage. In addition to expenses and capital requirements, you need to account for Working Capital requirements in your cash needs. This becomes increasingly important as you are ramping revenue. Investors will sometimes discount this need and say, “You can always get a working capital line of credit when needed.” This may or may not always be the case. Regardless, you need to articulate your working capital requirements in your financial model.

(6) Tie-In with Assumptions of Market Size, Growth, and Share

Any believable revenue plan must be grounded in “reality”. Reality starts with an understanding of the potential target market size and growth. Take a look at Market Research for Startups: Is it Important?

Who are the customers? What makes your solution so compelling? How much value does it have for the customer? This needs to be based on how the problem is being solved today, and translates into how much you can charge for your solution. What kind of market share can you expect over time? If you are an innovator, you will start with 100 percent of the Served Available Market, or SAM, and eat into the Total Available Market, or TAM, over time. If you are addressing a large and rapidly growing market opportunity, then it will attract competition. How will you sustain your competitive advantage and maintain a dominant market share over time?

I HATE financial models that assume the company can be HUGE if they just get 3 percent market share. Three percent market share is NOT defensible! If you are creating a new market and have 100 percent of the SAM, and you have a massively more attractive value proposition than the current solution, you may have 3 percent of the TAM in the early going, but eventually the whole market will convert to the new and innovative solution. Describe things in that way if you want to garner investor interest.

(7) Proof of the Business Model

At the end of the day, investors want to see a business model that works. A working business model from a venture capital perspective will translate into a minimum 10X Return on Investment, or ROI, but they really want to see something much larger in their best opportunities since so may investments will fail. The way to drive this kind of valuation is to have a model with explosive revenue growth, healthy gross margins, operating leverage, and sustained growth in revenue and profitability. I hate to say this, but in the private company world, top-line growth is the MOST important thing. You just need to be profitable.

(8) Implicit Inclusion of Critical Milestones

Investors want to see the timeframe and proof points in the business model. Base your step function increases in revenue on something real, like XX number of new customers coming on board and generating YY revenue each. Have a sales funnel that demonstrates this potential revenue.

There are two things that I know about good market opportunities. First, they exhibit explosive growth. Second, it is almost impossible to predict when the explosive growth will ignite. Read Crossing the Chasm by Geoffrey Moore. That said, you have to show the inflection point and growth in your model, and it needs to be grounded in something more than “the miracle happens here.”

(9) Demonstration of the Resiliency of the Business Model

Running “scenario analysis” and “sensitivity analysis” on a variety of variables can test resilience of a business model. Implicit within your financial model, you need to have run different scenarios. Maybe run an optimistic, typical, and pessimistic case. Also test the model for sensitivity to average selling prices (ASPs) and cost of goods sold (COGS). You should know the numbers at a high level, and have someone on your team that knows the numbers cold, hopefully both your finance person and your marketing person, from different angles. You need to have a suitable ROI under various scenarios to garner investor interest in your deal.

(10) Funding Request and Usage of Funds

If your business plan is being used with investors to try and raise capital for your company, you will need to demonstrate knowledge and flexibility. Knowledge is having a financial plan that is grounded in reality and that you can defend. Flexibility is demonstrated by your willingness to raise less money right now and have a “Plan B” that still achieves significant milestones. Investors may still want the “swing for the fences Plan A”, but they want to know you can be flexible.

Download our FREE guide to Building a Fundable Business Plan.

This is Patrick Henry, CEO of QuestFusion, with The Real Deal…What Matters.