In my interaction with other Angel investors, one of the biggest challenges in implementing a winning Angel investing strategy is to get quality deal flow, especially if you want to make a reasonable amount of investments. Another issue, depending on your net worth, is how many deals you can realistically afford to invest in and timing your investments right. I see a number of Angels get frustrated or bored or impatient and they decide to make an investment in “the best company that they can find.” Typically the investment size is $25,000 to $50,000, and sometimes more. Many of them can only make half a dozen investments on Stocktrades at this level without getting overly concentrated in this asset class. As a result, they have significant heartburn if their investments go south, so having a list of the best forex brokers could be a good move for your potential investors. I started asking myself, does this really make sense?

What is an Angel Investor?

An Angel investor is is an affluent individual who provides capital for a business startup, usually in exchange for convertible debt or equity ownership. To make these types of investment, in accordance with the rules established by the U.S. Securities and Exchange Commission (SEC), you need to be an “accredited investor”. In the United States, to be considered an accredited investor, you must have a net worth of at least one million US dollars, excluding the value of your primary residence, or have income of at least $200,000 each year for the last two years (or $300,000 combined income if married) and have the expectation to make the same amount in the coming year. But is $1,000,000 of net work really a sufficient amount to be an Angel investor? Let’s take a look.

What is a Diversified Portfolio and Why is it Important?

In theory, investments in private companies would provide higher risk, but also potentially higher reward. The long term data proves this out as shown in U.S. Venture Capital Index® and Selected Benchmark Statistics compiled by Cambridge Associates. Keep in mind, this data is aggregated and assumes a diversified portfolio of venture investments.

As pointed-out in the article in U.S. News and World Report, When Diversifying, It’s Asset Class That Matters, there is diversification within asset classes, but more importantly diversification across asset classes that matter most in managing an investment portfolio. A lot has been written about managing portfolios, but as I learned in business school the fundamentals of Modern Portfolio Theory really hinge on the Capital Asset Pricing Model and Achieving Optimum Asset Allocation.

As the theory goes, you want to eliminate unsystematic risk that really doesn’t provide a reward, and only be left with systematic risk which rewards you with the proper risk reward. Depending on your risk tolerance, you want to have a more conservative or more aggressive asset allocation, with equities being the most aggressive assets that provide higher risk, but potentially higher reward. Let’s assume that Angel investors are more aggressive investors, since small cap stocks are the most risky asset class, and private company venture investments are the highest risk assets in the small cap asset class. An aggressive portfolio would have 65-70% equities, and a very aggressive portfolio would have 80-100% equities.

So, for hypothetical purposes, let’s say that you are a super aggressive investor and you are investing 100 percent of your net worth in equities. Even with this model, you’d want to put some money into Large-Cap “Blue Chip” stocks, some into Mid-Cap stocks, and some into Small-Cap stocks. For arguments sake, let’s say you put a third of your net worth into each. If you have a very aggressive investment strategy, you’d have between 10% and 25% of your money in private venture investments.

Angel Investing Strategy: Diversification of Your Angel Investments

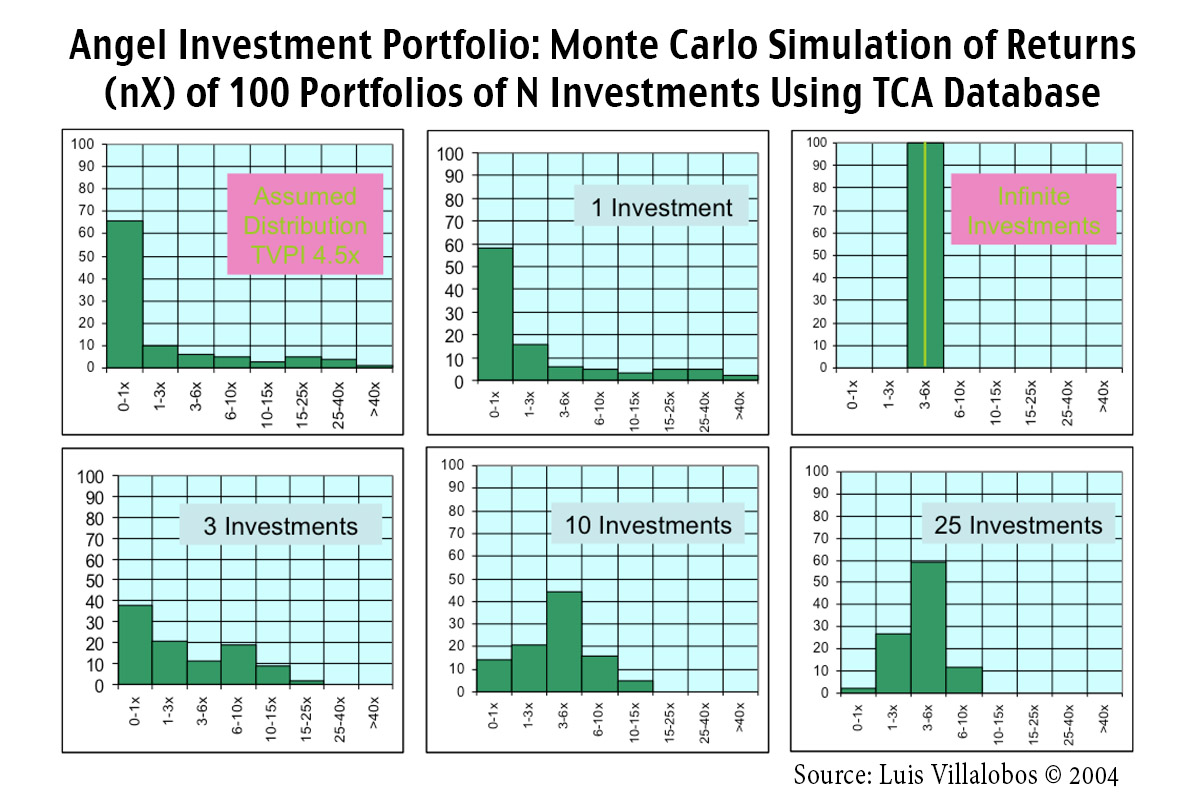

Diversification across asset classes is critically important, but as it turns out, diversification within an asset class is also important. In 2004, the famous Angel investor and entrepreneur, Luis Villalobos, who was also the founder of the Angel investing organization Tech Coast Angels, developed a Monte Carlo Simulation based on the data from all of the venture investments made by the Tech Coast Angels. To learn a little more about the theory behind this, check-out Monte Carlo Simulation description from Investopedia.

What Mr. Villalobis found was that the optimum number of venture investments was 25 investments to get the optimum return, and it is probably a really bad idea to make less than 10 investments. Now a typical venture fund has a 10 year life, but most of the early stage company investments are made in the first five years of the fund life. With that analogy in-mind, an Angel investor would want to find three to five companies a year to make investments. The results of his study are shown in the graphic below.

Now, if you are a good Angel investor, you won’t just randomly pick companies using a dart board, but failure to diversify may be even worse than using a dart board to pick 25 venture investments. That said, one of the best articles that I have seen about making venture investments is Valuing Pre-Revenue Companies from Kaufmann eVenturing. In my view, the most important thing in private venture investing is to make enough bets, the second thing is to pick good companies with great management teams. The Kaufmann article shows a pretty good process in assessing specific investment opportunities.

Let’s Do Some Math

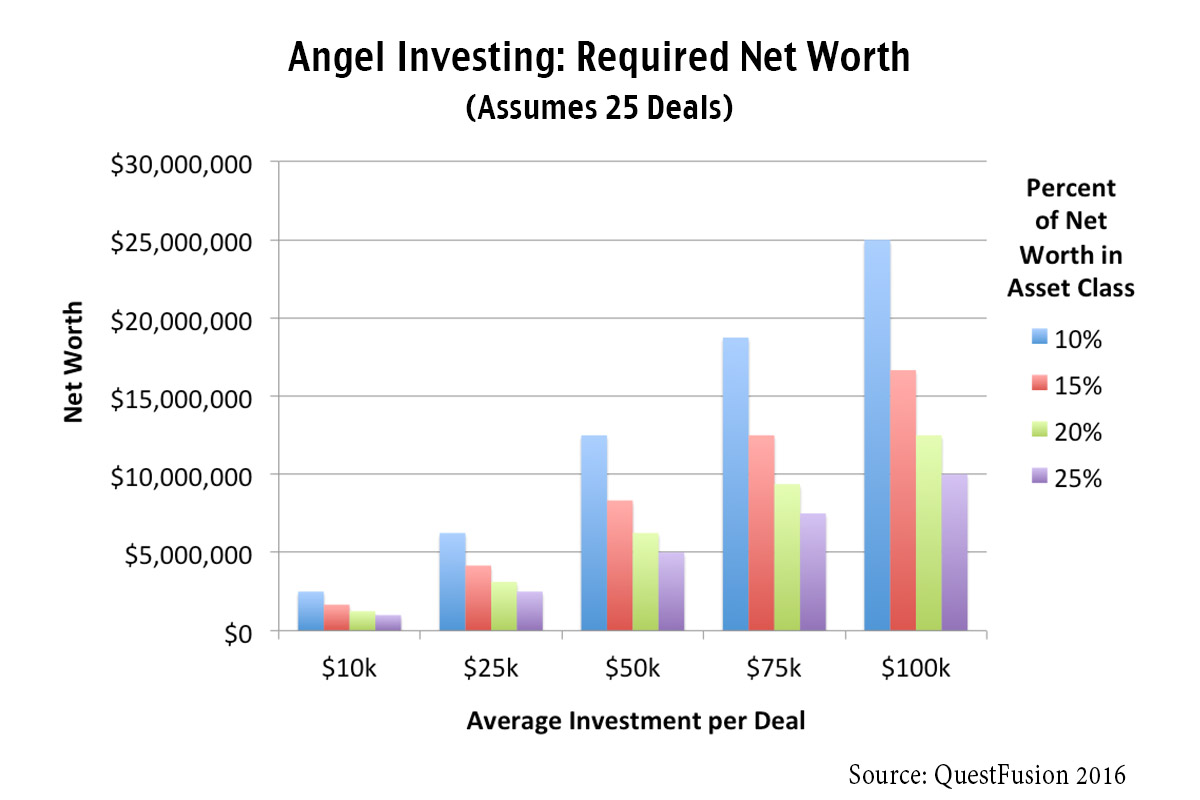

So how much money do you need to be an “intelligent” Angel investor with a reasonable Angel investing strategy? Let’s take a range of average Angel investments from $25,000 to $100,000 per company. These are the typical minimum investment levels requested by entrepreneurs looking to do a Seed investment round. I included a $10,000 minimum investment, just because I sometimes see $5,000 and $10,000 minimums in some syndicated Angel investing deals.

Bottom like, you really need to have a minimum net work of $5 million to be an Angel investor, and a net worth at least $25 million to be an Angel investor that can lead deals, while still maintaining a diversified and balanced investment strategy. Super Angels that are making investments of $500,000 to $1,000,000 per deal need to have a net worth of about $75 million to execute on a diversification strategy like this.

Angel Investing Strategy is about “Betting on Horses” versus “Riding a Horse”

As an entrepreneur, I like to make bets on myself. An analogy would be that I like to pick the horse, ride the horse, and win. Historical data also shows that the vast marjory of personal wealth creation has occurred by the accumulation of concentrated equity positions. In other words, most “self made” billionaires are a result of starting a company and making it successful. Don’t get me wrong, I am not a billionaire, but the vast majority of my wealth creation has been based on me picking and riding horses. The next group of billionaires are a result of inheritance. Most of us don’t fall into that group, and we can’t get into that group unless we are born into it. My former board member and former Kleiner-Perkins board member William R. Hearst III falls into that esteemed group.

I am also an Angel investor, which is something completely different than being an entrepreneur. As an investor, to use the same analogy, I am making bets on other horses, and other jockeys. The most successful “horse better” is Warren Buffet. He became a billionaire by making bets on other horses.

Now this is not to say that you can’t take a very active role in your investments. Mr. Buffet frequently takes a controlling or very strong active role in his investments. On a smaller scale, some Angel investors also take an active role in their investments. However, typically if you are going to take an active role in an investment, you need to have lead or co-lead an investment round, and ideally also have some technical and domain knowledge associated with the business. In this case, you may become a part of the board of directors or an advisory board. However, even if you are the executive chairman of a company, you are still betting on the company CEO and his or her team as the “jockey” for your horse.

The remainder of the Angel investors typically take a passive investment role, but may monitor the progress of the company through the activist, especially if the are involved in the investment through a syndicate or some Angel investing organization.

Angel Investing Strategy: The Two Ends of the Spectrum

So, does this mean that you can’t be an Angel investor if you barely meet the accredited investor requirements set by the SEC? I think there are really two issues that arise here: deal flow and investment minimums.

If you are a lower net worth individual that wants to take a lead position on deals, you are taking the role of the “virtual jockey”, so you better make sure the deal terms are right, and you are taking a very active role in the company, likely as the executive chairman of the company. This is a more risky strategy, but fuels the entrepreneur that exists inside of some Angel investors. I think if want to make this your investment style it is fine, as long as you know the inherent risks. You had better have significant domain and technical expertise in the business, and you better have an exceptionally good relationship with the founders and the CEO of the company.

The other alternative to address the issues of deal flow and investment minimums is to invest in deals through investing syndicates available on platforms like Angel’s List. Another alternative is to make investments in companies through platforms like Crowdfunder and PropelX.

The third alternative to get exposure to startups and private emerging growth companies is to be a limited partner in a venture capital firm or in a fund of funds that invests in venture capital firms as a limited partner. This may not be as exciting as being an Angel investor, but could be a much wiser investment strategy if you cannot afford to construct a sufficiently diversified portfolio or take a role with sufficient and significant influence in the companies where you invest.

My Investment Philosophy and Conclusions

I lot of investors like to talk about their winners, but are they really making long term returns consistently in their private venture investments? Is this really an Angel investing strategy? It reminds me of someone that goest to Las Vegas frequently and talks about the one or two times that they won big at the craps table or in the poker room. Are they really winning on a consistent basis? Have they been practicing routinely on online gambling sites like Casino-Korea.com to ensure they’re skilled enough to win big? If they’re winning consistently, how are the casinos able to build mega-resorts? There is a reason that they call it gambling for the patrons and gaming for the casino owners. Getting back to Angel investing, I know that the venture capital industry has not had very good returns over the last 10 to 15 years, with the possible exception of the last few years, and those returns are far from certain.

I haven’t made a single Angel investment this year and I’m pretty proud of myself. I am not really interested in making passive Angel investments unless I see broad-based performance that compensates me for the additional uncertainty and liquidity risk of private company investments. See What You Need to Know About U.S. Venture Capital in 13 Charts.

I continue to attend Angel investor forums, meet with a lot of companies, review a bunch of executive summaries, and have even been involved in some due diligence on a couple of deals. I also look at deals and syndicates on Angel’s List, but want to see some better performance metrics before jumping-in with this approach. I think the recent correction that occurred late last year helped on valuations, but I still think there is another shoe to drop. I’m not even sure if I will make a single Angel investment this year even though I would like to be in three to five deals per year, and have one deal where I am very actively involved. I’m just not willing to deviate from my rigorous investment screen and investment philosophy. I’m not going to be the poker player that goes all-in just because he hasn’t played a hand in a long time. As a result, even though I have a more aggressive investment strategy, right now I am primarily invested in high quality large-cap equities with high dividend yields. I am also keeping a pretty good amount of cash on the sidelines in today’s uncertain market. I don’t like any bonds at all right now, and I’m not really crazy about real estate either due to the risk of interest rates going up. I have some international exposure, but not a huge amount.

What has been your experience with Angel investing or working with Angel investors in your startup? Do you think valuations are starting to be more reasonable? Do you think it is a good time to be making Seed stage investments? Are you investments working for you?

This is Patrick Henry, CEO of QuestFusion, with The Real Deal…What Matters.